Why don't more VCs invest in IT Consulting companies?

I was at a Bangalore tech mixer last month when a VC asked me what I did. I replied that I work for an IT consulting company called Calsoft. She said, 'how boring,' then literally turned to someone else and continued chatting.

A month prior to that I used to work at Replit (opens in a new tab) , an AI dev-tools startup based in the Bay Area. I'm pretty sure this same VC would have found me "interesting" had I had met her then.

To be clear, I love product startups. I am an active angel investor, worked at a consumer tech VC Lightbox (opens in a new tab) and some of the most transformative learning experiences of my life were in startups like Replit (opens in a new tab) and Hopscotch (opens in a new tab). Product startups when done right are unmatched in terms of impact and general net goodness in the world

But, this conversation did get me thinking - why are bootstrapped IT consulting companies considered "unsexy" in comparison to product startups that typically do require VC funding due to the high amount of upfront burn?

I'm going to let you in on a secret - IT consulting companies don't really want to be in the limelight.

After all, why trumpet to the world about your profitability and attract more competition?

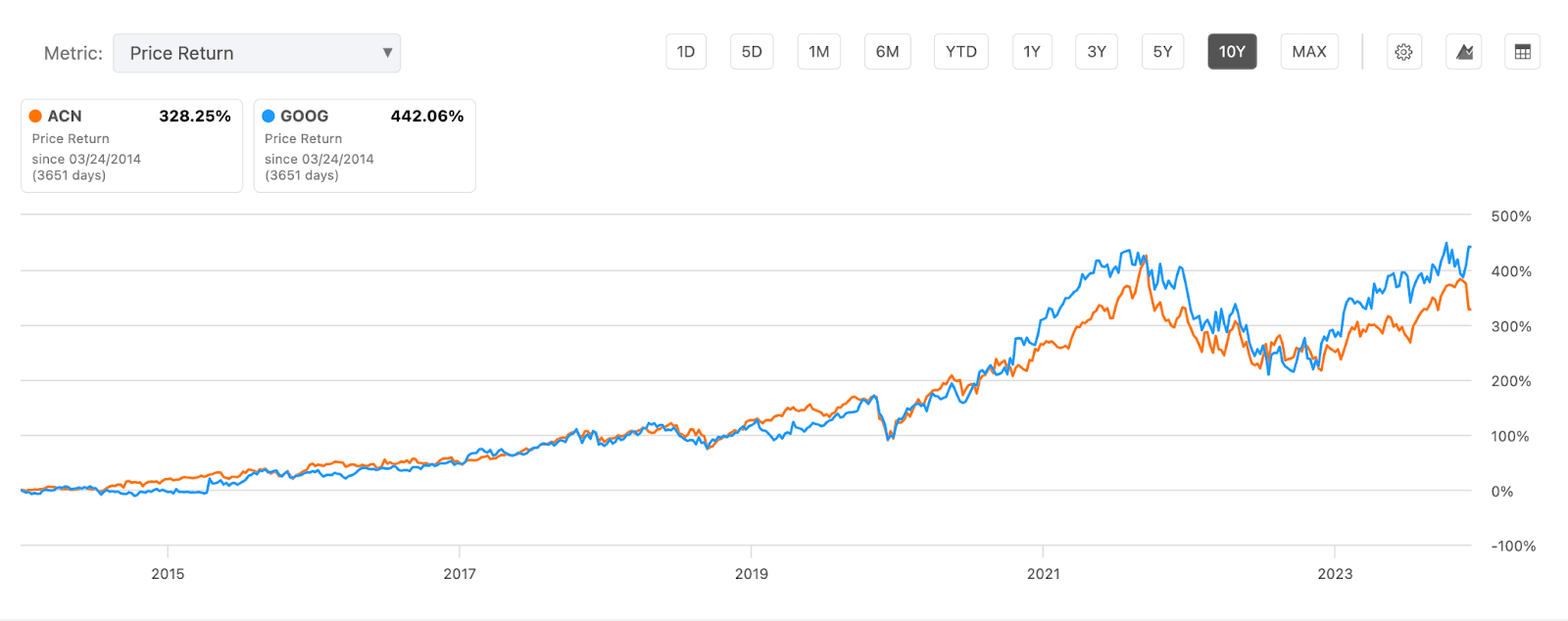

Case in point: Accenture has delivered nearly the same stock market return (it was equal until last month) as Google over the past 10 years. In fact, it's Gen AI revenue surpasses all VC-backed startups' revenue combined (opens in a new tab) (barring OpenAI).

Did you know that the largest 4 out of 5 technology PE deals in India (opens in a new tab) since 2022 were not product companies, but instead IT consulting companies? The fifth largest one was BYJUS - and the less said about that one, the better.

Did you know that Infosys had a higher return on equity ratio (31.6%) than Meta (28.04%)?

IT consulting entrepreneurs like Narayan Murthy and Azim Premji showed that it was possible to create generation-defining wealth for not just themselves, but their employees as well, all while building world-class companies that their clients relied on to create technology.

So why don't more VCs back IT consulting companies?

One reason could be due to the nature of returns expected by VCs. To make their fund economics work, VCs require a return of at least 10x on their original investment. IT Consulting companies are thought to not be able to deliver that level of growth or scale.

But let's do the math to see if its actually true.

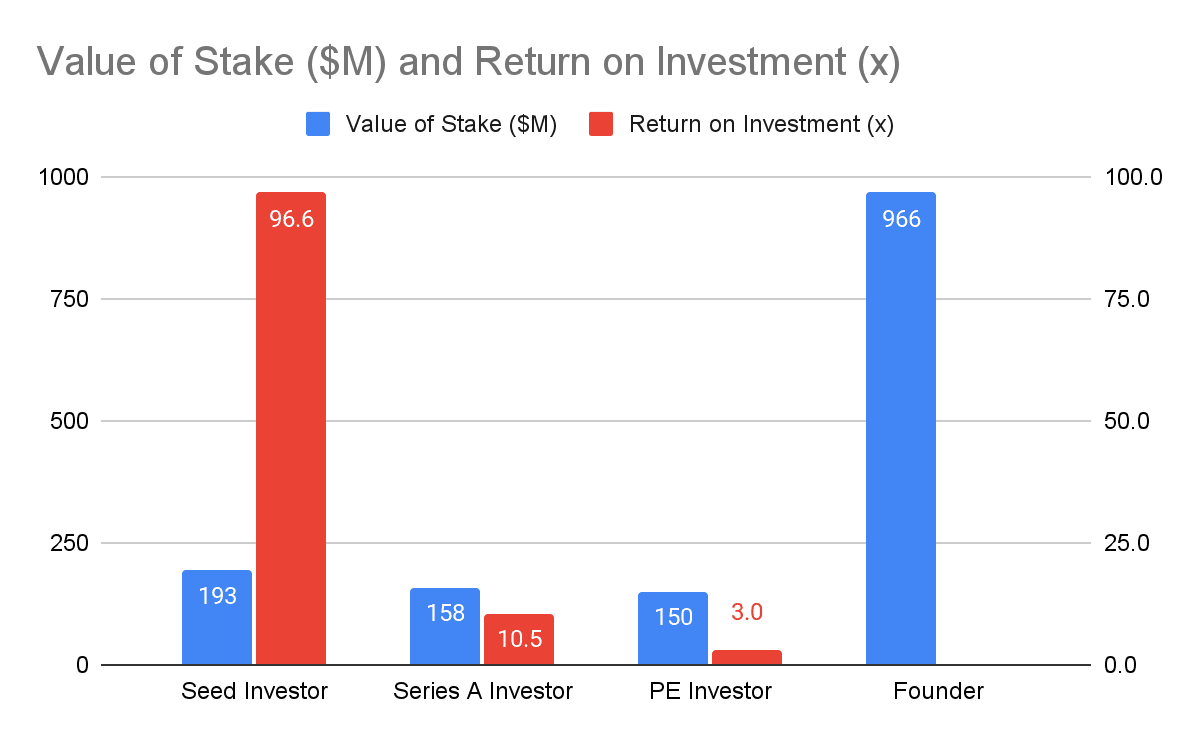

Let's take a hypothetical company called AI Consulting. AI Consulting raises $2M in seed funding on a business plan at a pre-money valuation of $10M. Let's assume this takes them to $15M in revenue (~Rs. 100 Cr.).

If they then decide to raise a Series A, we can apply a conservative 7x revenue multiple giving a pre-money valuation of $110M. At this point, institutional investors like Accel and Nexus will come in and put in a check of $15M.

This can realistically get them to $60M in revenue which makes it attractive for the PE folk. Applying the multiple as before gives a pre-money valuation of $440M. Let's assume they raise $50M in funding.

Let's assume the company decides to IPO @ $200M in revenue at a valuation of $1.4Bn. At this stage, this is what each of the previous investors' stakes looks like -

The seed investor has made 96x on their original investment while the Series A investor has made 11x. And the founder(s) own 66% of the total company or close to a cool $1Bn ($966M to be precise).

Happiest Minds Technologies (opens in a new tab) did something similar. It was founded in 2011 by IT consulting veteran Ashok Soota and raised ~64M in funding before IPOing in 2020. At the time of IPO, it had just closed FY '20 with $100M in revenue in the first year of the pandemic. On the first trading day, it opened at a valuation of ~330M and doubled on the first day of trading to $700M. Mr. Soota's stake at the time of IPO was worth $173M; today it is worth $730M.

So coming back to the original point - yes, it is profitable for VC firms to invest in IT consulting companies.

IMHO they don't because it just isn't sexy enough.

After all - how do you justify to your LPs (the investors that invest in VC funds) that instead of backing SpaceX or Flipkart, you're backing an IT consulting company?

However, this is changing recently. For example, Peak XV Partners (opens in a new tab) recently invested in realfast (opens in a new tab) , a services company focusing on the Salesforce partner ecosystem. Meanwhile over in the US, Coatue (opens in a new tab) invested in Distyl AI (opens in a new tab) , an OpenAI implementation partner.

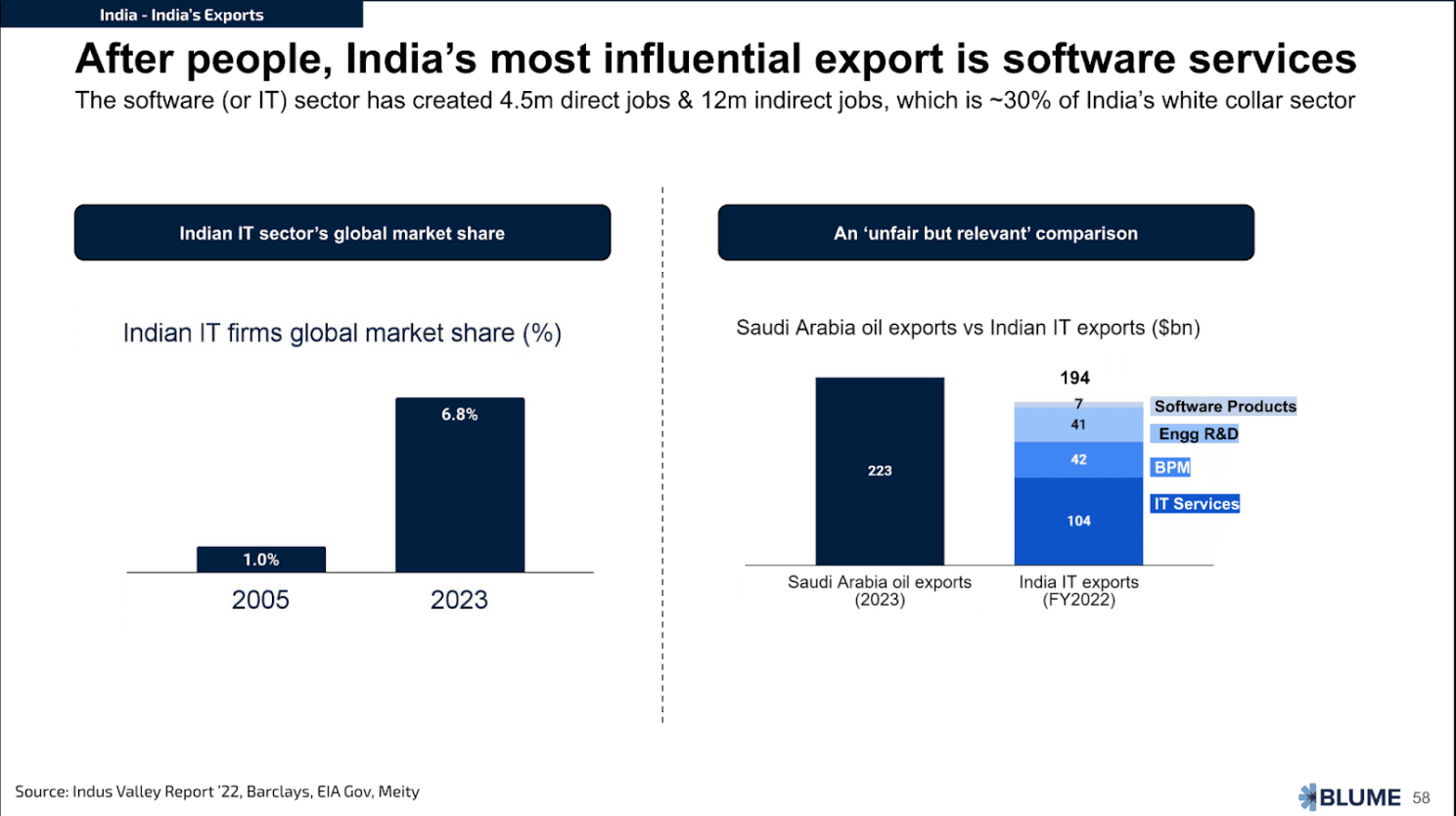

As an executive director at a small IT consulting firm, I want to shed more light on an industry that accounts for more exports for India than oil does for Saudi Arabia. I plan to write on a few related questions like:

- What is the impact of gen AI on the IT consulting industry?

- How are IT consulting companies so profitable?

- How do you start an IT consulting company - and how do you raise money from VCs?

Please DM or comment with any feedback or suggestions!

Special thanks to Sid Puri (opens in a new tab) and Rohan Bhide (opens in a new tab) for reading early drafts of this and providing feedback.

© Anshul Bhide.RSS